Wealth Management

Our team of expert chartered financial planners and wealth managers offers a comprehensive range of services to help you manage your wealth for your future, that of your loved ones and generations to come.

Wealth management is no longer the preserve of the highly affluent. The increasingly complex financial, legal and tax landscape means people from all walks of life would benefit from such services.

We take a comprehensive approach in meeting the complex and broad financial needs of our clients. Our ongoing wealth management services are bespoke and designed around you and your family’s needs, goals, and ambitions.

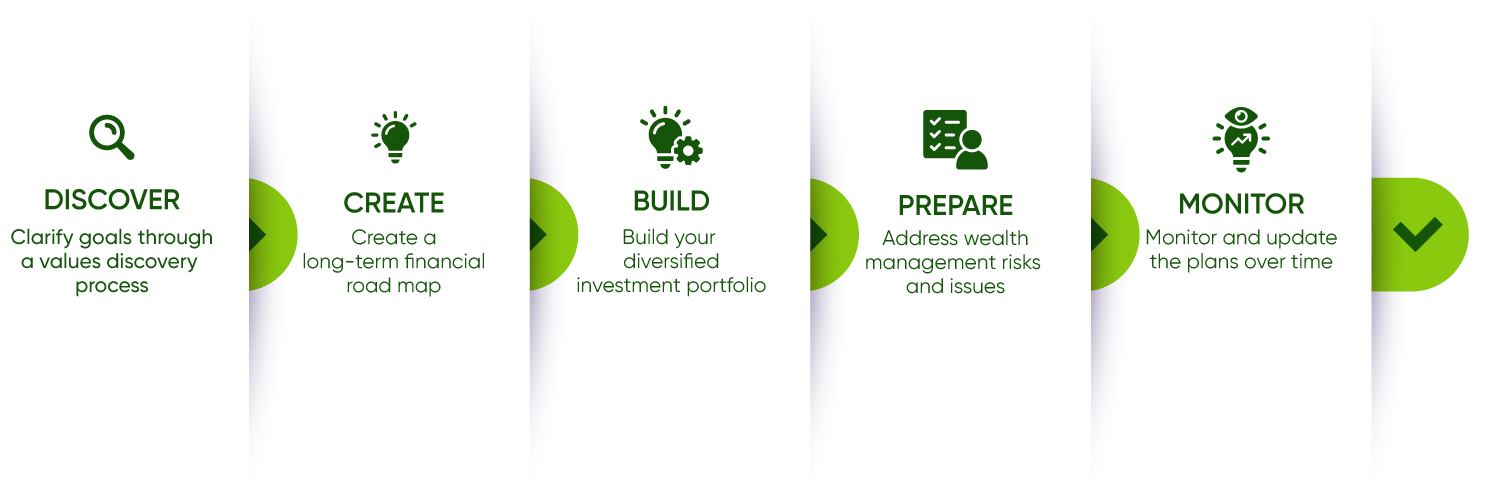

5-step wealth management process

We offer a wide range of services, including but not limited to:

With our ongoing management, we’ll support you every step of the way, ensuring your strategy stays on track and adapts to meet the evolving lifetime goals of you and your family.

Contact us today to schedule your free initial consultation and take the first step toward turning your dreams into reality.

The advisers at Path are very skilled with your finances, what you need and how you can make your assets work in a way which allows you to live your life as you want to live.

– Stefan Atkinson, Path customer since 2022

Our aim is to preserve and grow your wealth while effectively managing and mitigating risks.

Book a free consultation

AS FEATURED IN

A COLLECTIVE CALL FOR CHANGE

Our accreditations and memberships

RISK WARNING

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.