Insights

Financial Planning for Elite Sporting Professionals

Is your sporting dedication matched by your commitment to financial wellbeing? We help sports professionals plan and implement a robust financial strategy, for during and after life in sport.

You have a unique profession, forged by years of dedication and focus from an early age. When your playing career ends – typically much earlier than traditional careers – a new chapter begins. At Path, our chartered advisers understand the crucial role a tailored financial plan plays in securing your financial wellbeing both during, and after life in sport.

As specialists in future-focussed and sustainable investment strategies, Path can also account for a range of sustainability preferences with your investments.

Your professional sports career will be demanding, and relatively short, even without the potential for setbacks or injury. With the average retirement age in English football being 35*, there are still decades of expenditure to meet after hanging up your boots. The unique challenges facing sports professionals – such as running out of money or even bankruptcy – can be seen across the globe.

Previous research has shown nearly 16% of NFL players file for bankruptcy within 12 years of retirement.** Closer to home, in 2024 Wes Brown (England international footballer, and over 350 appearances for Man United) pointed out that his financial troubles stemmed from not having the right people around him.

As in sport, preparation is key when it comes to your finances.

Having a solid plan, delivered by a trusted adviser with your best interests at heart, gives you the opportunity to financially thrive, and focus more on maximising your potential during this limited window of opportunity.

In addition, for those who understand and care for the environment and those around you, and who wish to align their finances more closely with these values, Path is a leader in this field, having been awarded the Best Buy label by Ethical Consumer and being a Certified B Corp™.

Your career

Your earnings pattern is rare. Unlike traditional careers, where earnings typically snowball gradually over decades, elite sports professionals can be in receipt of large and fluctuating sums in their early 20s, often from multiple sources.

This gives you a distinct period to build long term wealth and future security. However, this opportunity often arrives just when training and playing commitments are at their peak, meaning there is little time left to stop and think about your financial future.

We can help you navigate common pitfalls and areas of uncertainty, commonly seen across:

Your comprehensive plan will look at the years ahead, long before you think you need to consider your next steps, and put the building blocks in place for future success.

Transition and after sport

At some point your career will pivot. This transition can appear seamless for some, and for others provides greater challenges. Putting a financial strategy in place early, can provide the flexibility and confidence to seize opportunities when the time arrives.

Even if your playing days are behind you, securing your financial future will still resonate. We help hundreds of clients at all stages of life, bringing value and reassurance to your long-term prospects and retirement plans, even if it is long after you have stopped competing.

Specific areas where we can help

Our promise to you

If a trusted partner in securing your financial future is what you need, please get in touch.

For more details, or for a no-obligation initial consultation with one of our chartered financial planners, please contact us.

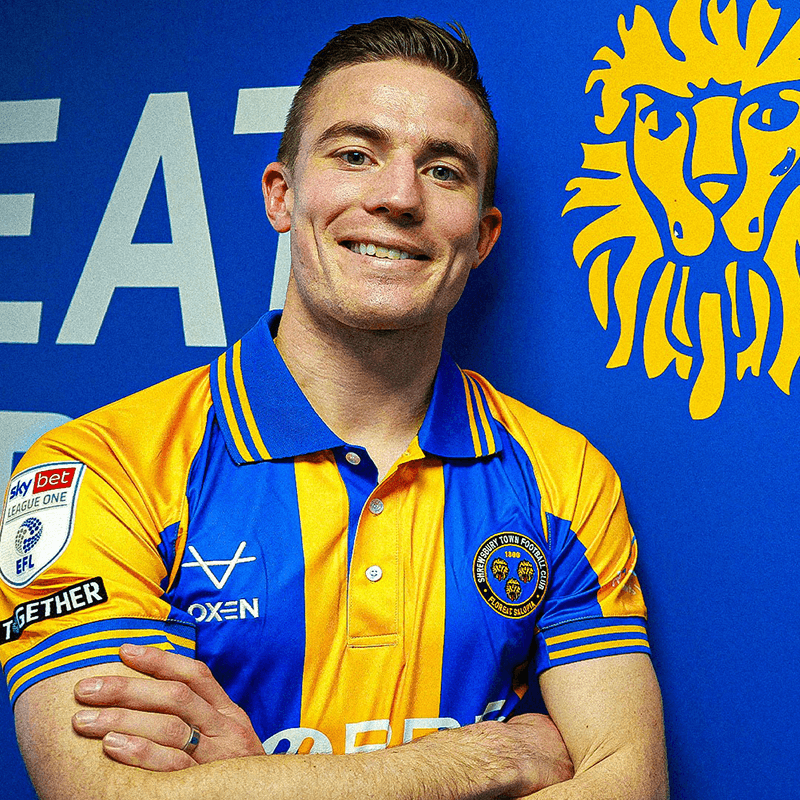

Customer story

David Wheeler

Book a free consultation

RISK WARNING

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.