Customer Case Study

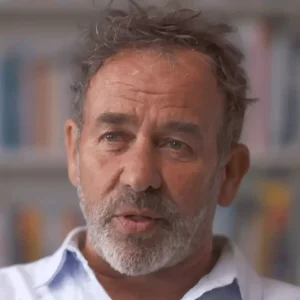

Gordon Barker

My wife was the real driver of moving our investments to Path. Now, our daughters are taking control of their investments too.

58-year old Gordon, from Kingston upon Thames, and his late wife Alison came across Path after reaching out to their existing financial adviser, who failed to align their money with their morals.

Gordon and his wife started investing with Path in late 2020. Alison was the driver of moving their investments over to Path, being very environmentally focused. After reaching out to their existing financial adviser about being more specific in their investment choices, especially around avoiding unethical companies, they looked to switch after they were told they didn’t hold those kinds of portfolios. They did some research and came across Path.

Gordon says:

We spoke to David at Path initially, and we were very happy with everything he was able to articulate. Ultimately, whilst you’re looking for an ethical investment portfolio, they are investments at the end of the day. We’re very happy with both aspects – the financial and the environmental – that Path could achieve. They also have a very robust narrative and strong history in investment.

Following this, they moved the majority of their assets over to Path, including ISAs, pensions and a trust for their two children.

Gordon and Alison had their business, The Vedere Partnership, which offered executive coaching and leadership development specialists.

Following his wife’s death, Gordon’s daughters moved to be directors of their business and have also become clients of Path Financial, with both being passionate about sustainability and their impact.

As a family, sustainability is integral to our way of life. We pretty much research everything we buy, in the truest sense – looking at the whole supply chain. We prioritise eating seasonally, when many supermarkets aren’t selling seasonally. If we do eat meat, we buy regenerative organic farming – British, local.

Choosing Path also helps our financial wellbeing, allowing us to make smarter and more sustainable choices that may traditionally cost a bit more money. With Path, you can be ethical and financially robust.

Gordon also remarks that Path tailor everything for his family and their philosophy, ensuring every financial decision benefits them and reflects their different stages of life. For his daughters, one of whom is an activist herself, decisions to maximise financial returns whilst also sticking to the family’s holistic philosophy is essential.

The levels of risk and types of investments my daughter’s ISAs and pensions are very different to the levels of risk in my portfolio. Path also help ensure I am getting my daughters in the best financial position as possible. The past couple of years have taught me this is essential, as we never know what could happen.

Path live and breathe the ethical approach that we’re looking for. The financial sector is purely operated by money, with no concern on how they make the money. Path Financial consider all sides, which aligns very well with our lifestyle.

What’s your advice to people who are thinking about moving their finances?

The first step is the mindset. It’s important to actually want to make a difference, not just from a climate perspective but for ethics. You’ve got to then explore and find the right people (financial advisers) for you that will give you that confidence that your investments will be properly looked after and will continue to grow. Find a company you feel you can partner with.

MORE CUSTOMER SUCCESS STORIES

RISK WARNING

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.