Customer Case Study

“As a footballer, I have moved my money away from fossil fuels and gambling – here’s how you can too”

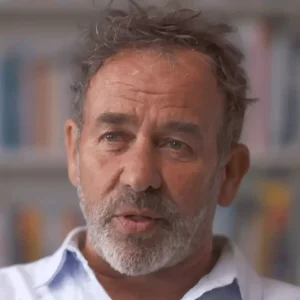

Former Wycombe Wanderers player David Wheeler recently decided to move his money to more ethical investments, after over a decade of climate activism.

Football, the multi-billion-pound industry that captivates half the world’s population and stands undisputably as the world’s most popular sport, has somewhat of a reputation.

There’s a lot of high luxury lifestyles in football…

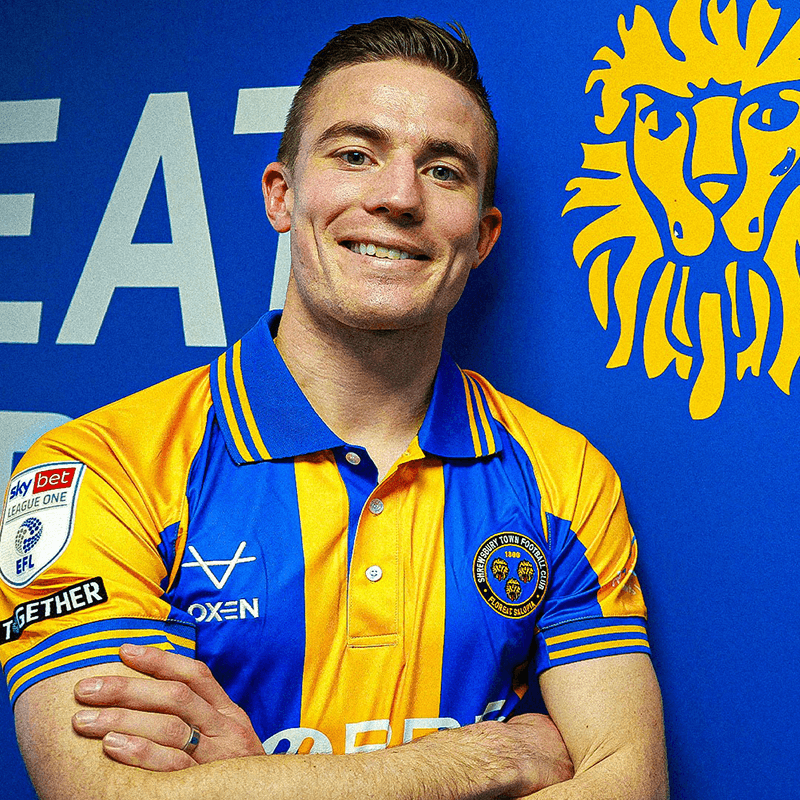

says 34-year-old Shrewsbury Town midfielder David Wheeler, in a nod to the extortionate wages of top players, jet-setting and big name sponsors that characterise the sport.

…and in the sport, there’s also a lot of greenwashing.

David Wheeler, 34, is a footballer that is trying to do things a bit differently, compared to most of his fellow players. Since his early twenties, after becoming more aware of the impact of climate change on the planet, Wheeler has been an advocate for better sustainability practices in the sport, regularly calling out FIFA, the sport’s governing body, for their partnerships with oil giants such as Aramco and controversial gambling sponsorships.

It’s very difficult when the governing body of the industry that you’re in, in my instance FIFA, is in bed with the oil industry but I and everyone else has their own decisions to make and they decide what to accept or not.

And Wheeler’s decisions to live sustainably extend far; as well as advocating for more ethics in sports, Wheeler is also vegan, drives an electric car and incorporated a lot of sustainable practices at his former club, Wycombe Wanderers, that he hopes will be there for years to come.

Recently, Wheeler, who is currently based in Windsor, made the decision to shift his personal investments towards ethical options, including a pension and ISA with Path Financial. He was introduced to ethical investing by a friend who shared his passion for climate activism.

Even within climate action, ethical investments were something I wasn’t fully aware of. From there, I found out how much impact finances make. I have a pension and an ISA, and I hadn’t realised how much of that money actually went into things that I didn’t agree with.

In the UK alone, more than £88 billion from pension schemes are invested in fossil fuel companies, amounting to around £3,000 per pension holder. As well as negating the risk of stranded assets, Wheeler realised he could be having a much greater impact on the planet by switching to green investments.

I think there’s an opinion for a lot of people where they feel, ‘oh, I’m just one person – how is my money or my voice going to make a difference? And why should I make that change in my finances for my ethics?

And I understand that viewpoint. But you have to factor in the risk of stranded assets with fossil fuels. At some point in the next 30, 40, 50 years – maybe less – we’re going to have to abandon fossil fuels completely. And if your money is invested in fossil fuels, that will be a lot more damaging.

Now, Wheeler is happy that his money will be invested in social good – such as clean energy and renewables, healthcare and education, and social housing projects – rather than so-called ‘sin stocks’ such as alcohol, tobacco, gambling and weapons manufacturers. As well as making a difference with his money, the move also means Wheeler feels more confident about his financial future after football.

You dedicate the first part of your life to being an athlete, and often that’s all-consuming. So it’s important for athletes to plan and prepare for life after sport and not feel that you’re financially constrained. It’s about looking at the long-term perspective. If your money is in a pension, the amount of damage you can do with your own money in 30 years is quite scary. If you switch to a more positive and ethical pension and you are doing good for 30 years, that’s something to be really proud of.

So how do people start to move their money away from fossil fuels?

Many people may not be aware that they could move their workplace pension to a more ethical alternative, or that many fund managers offer ETFs that prioritise investments in renewables and clean energy as opposed to damaging fossil fuels.

For Wheeler, accessible financial education is the first step to a greener financial future.

Financial education isn’t good enough in schools, colleges or even universities. You have to go and seek the information out. I think any financial education should also include information about green investments as well.

As part of my role as Sustainability Champion at the PFA (Professional Footballer’s Association) we want to offer workshops for players to learn more about the issue and learn how they can have an impact.

Wheeler hopes his work can encourage other football players to follow suit, with many women’s football players such as Katie Rood and Sofie Junge Pedersen already leading the charge in the sport.

A lot of football teams are sponsored by airlines, car manufacturers, or petrochemical companies. It’s embedded in football. So I think football is seen as incompatible with sustainability, and that is exacerbated by the narrative that to be sustainable you have to be perfect.

James Harrison, Chartered Financial Planner at Path Financial, said:

It has been great to work closely with David in recent months, to gain an understanding of his personal drivers and motivations, especially in the context of his sporting career. The world of sport has enormous reach, and individuals who make their voice heard in that world are often a powerful source of change, and definitely so if they put their money where their mouth is as in David’s case. He’s certainly not alone however, and we are always happy to discuss how we can assist current or retired sporting professionals with their overall financial security and closer values-alignment.

MORE CUSTOMER SUCCESS STORIES

RISK WARNING

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.