Customer Case Study

The world felt completely out of balance, and we knew we didn’t want to contribute to the problem

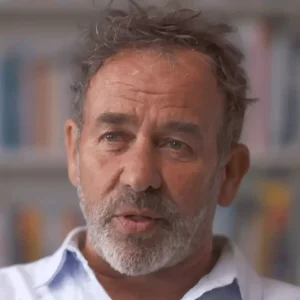

Andrew and Becca, both 56, live in East Lothian in Scotland. Andrew, who has a background in banking and accountancy, now works part-time and dedicates his free time to his community as a treasurer for a local mental health charity, as a coach and chairperson at his local athletics club and where possible, volunteers with a youth charity. Becca has been a garden designer for over twelve years, focusing on sustainable solutions and soft landscaping.

Andrew and Becca made the switch to Path Financial back in 2022 after struggling to find a financial provider that genuinely specialised in green investments.

Andrew says:

We were looking around for somewhere to invest, but we didn’t want our money supporting oil, gambling, or tobacco. We wanted a specialist in green investments, but it was hard to find anyone who truly met our criteria. That’s when we found Path.

Andrew and Becca knew they had to be more intentional with their investments. Becca recalls how global instability, including the war in Ukraine, the lingering effects of COVID-19, and the Australian wildfires, heightened their awareness.

Becca says:

The world felt completely out of balance, and we knew we didn’t want to contribute to the problem. I find it quite hard to make a difference with a vote on a piece of paper – it doesn’t seem to make much difference. I thought well at least you can make a difference by putting your money into something that is moving the world in the right direction.

Becca’s career has also mirrored this shift. Where garden design once meant clearing and starting over, she now advocates for a softer approach—working with what’s already there, and planting trees instead of paving over green spaces.

As a couple, they’ve adapted their lifestyle to be more sustainable. They eat less meat, use public transport, and travel across Europe by train rather than flying where possible – including travelling from Zurich to Edinburgh in a single day on trains.

Andrew says:

I’ve become much more aware of our environmental responsibilities over the past few years. Investing ethically is about making a real impact—it does more than simply cutting down on flights or driving less. In the long run, industries like oil are in decline. The future is in renewables, and it just makes sense to invest in that.

With early 2025 bringing renewed political challenges around fossil fuels, Andrew remains determined.

Andrew says:

You might have one country pushing fossil fuels, but the broader trend is clear—industries and countries are moving towards sustainability. It just reinforces our decision to keep our money where it can do the most good.

MORE CUSTOMER SUCCESS STORIES

RISK WARNING

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.