Women & Finance

At Path we think that women need to talk about money

By not talking about money and by not asking the right questions about what our money is doing we are inadvertently giving up control.

This can affect women in all sorts of ways and at every stage of their life journey – from being poorer at retirement or after another significant life event such as having children, splitting up with their partner or leaving their job.

We believe that money is one of the last big taboos still facing women. But us not speaking about it is not making the problem go away – and in fact in many cases it is just storing up problems for the future – both our own and the planet’s.

At Path, we know that women are twice as likely to want to invest their money in line with their values.

Yet paradoxically, at the same time women are giving up their ability to do more of what they want to in the future by not giving the financial aspects of their lives as much attention as they could – either as a deliberate choice – or more often, even without realising it.

Not actively taking an interest also means that many women (and men!) don’t know that their investments are propping up industries that are damaging the planet.

We’re on a mission to start the conversation by actively talking to more women about their finances. From discussing ceding control to seeding change – we want to engage women in discussions that allow them to regain or retain financial choice, freedom, power and purpose.

Because purpose is one of Path’s key missions – we help people to align their money with their values.

At Path more than 50% of our customers and 30% of our adviser qualified staff are women. As well as shaping the general conversation of women and finance, we are also committed to changing the landscape for women in the financial industry – supporting and encouraging the best female talent in the industry to gain recognition and career success.

We are passionate about empowering women in regards to their finances and their choices about where their money goes and what impact it can have. That’s why you’ll see us at events such as the Women of the World festival talking about money and asking more women to start a conversation with us – but also with their female friends – about their finances.

Will you join us?

Investing for gender balance & diversity

To arrange your free consultation, complete the form below and one of specialist team will get back to you.

Path Women – Our thoughts & journey within finance

I have always loved numbers from an early age, and at one point during my school years, thought I might want to have a career as an accountant. However, after leaving education I got a temporary job in the financial industry and my passion grew from there. I realised quickly that pensions are really interesting, (not to everyone!) and started taking exams to support my career.

Over the years I have spent half my time in a management role and the other half in support or advisory roles. As I read more and more, worked for different organisations and gained lots of experience, I could identify the gaps on how the financial industry fails women and lacks focus on sustainability. It was also tough to feel completely comfortable with the options available for investing, when it didn’t match my own personal values. I vowed that I want to help as many women as possible with financial advice, and particularly saving for their future retirement.

After reading an article in the Financial Times, I found Path, and was so heartened to find someone who sees financial services like me, and knows there is another way, a much better, sustainable, ethical, equal, fair, open and honest way. I jumped at the chance to join and am loving this opportunity to be part of something much bigger and most importantly to know that we are genuinely making a huge difference!

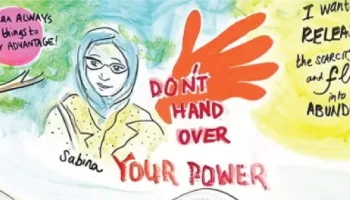

During our attendance at the Women of the World Festival, London, we had the pleasure of having the visual minute artist, Julia Miranda capture some of the thoughts, concerns and feelings of women regarding their relationship with money.

Many spoke to Julia or the Path women on our stand, others attended and participated in the Money & Me finance panel discussion hosted by Jude Kelly, and others simply noted down their pledges to themselves, the planet and future generations on our UN SDG tree’s seed paper leaves. This beautiful piece of artwork encapsulates the different journeys that many women go on with their finances and the factors that they have to consider along the way. It’s a conversation we are proud to have started and look forward to continuing.

Women in Finance Charter

Path is proud to have signed HM Treasury’s Women in Finance Charter. We are committed to working alongside other signatory firms to build a more balanced and fairer financial services industry for all.

More from our Women & Finance series

- Women & Finance

- Trust planning

- Stewardship

- Retirement Planning

- Products

- Pensions Technical

- Pensions

- Pension Types

- Other Terms

- Other

- News

- Legacy Planning

- Knowledgebase

- Investments

- Investment Planning

- Investment Basics

- Growing your wealth with Path Financial

- Goals-Based Investing

- Financial Planning

- Events

- Ecosystems & Resources

- Customer Stories

- Charities

- Businesses and Charities

At Path we think that women need to talk about money

By not talking about money and by not asking the right questions about what our money is doing we are inadvertently giving up control.

Guide to Divorce

Divorce is a life event that can have both immediate and long-term financial impact. It ranges from short-term worries such as cashflow, your children and your home, to future concerns, such as pension provision and how to navigate later life with a single income.

Seeding Change

We’re on a mission to start the conversation by actively talking to more women about their finances. From discussing ceding control to seeding change – we want to engage women in discussions that allow them to regain or retain financial choice, freedom, power and purpose.

Protecting your money and mental wellbeing

Money worries can have a hugely negative impact on our emotional wellbeing. It can put a huge amount of stress on our lives, our relationships and even our physical health.